Updated: 24.02. 2024 🆕

Best PCO Insurance cost guide for PCO Drivers – from February 2024. Private hire insurance costs in 2024 are affected by current inflation. See below the updated price guide for 2024.

PCO insurance in 2024 will likely see a continued upward trend in costs compared to previous years. A reasonable estimate might be to add a small increase (5-15%) to current average prices.

PCO drivers with a clean driving record of at least three years, and no insurance claims, may qualify for No Claim Bonus discounts. This could reduce their Private Hire Driver Insurance aka PCO insurance costs to a range of £1660 to £2250.

New PCO drivers face significantly higher insurance costs, with estimates ranging from £2800 to £4136 per year. Current inflation is a major factor driving up these prices.

We have updated the insurance companies’ rankings based on private hire taxi insurance prices we received on February 2024 and feedback from taxi drivers.

Where can you get competitive PCO Insurance or Cheap PCO Insurance premiums in 2024?

Based on our research, ACORN Insurance and DCL may offer competitive prices for annual PCO insurance policies in 2024. Additionally, consider ACORN Insurance for potentially affordable monthly premiums. Remember, it’s essential to get quotes from multiple providers and compare them carefully before making a decision.

Guide for PCO Insurance in 2024

ACORN Insuarnce | Pay in Full | Payment Plan | Interest for Credit |

Premium Calculated for PCO Driver with 4 Years No Claim Bonus and Driving Estate Car | £1,765.27 | 1st payment: £344.00 10 payments: £166.00 | Interest rate for your monthly pay option at (variable) |

You will save £238.73 for full payment | Total including Interest £2004.00 | ||

Above illustrated prices are based on taxi drivers with three years no claim bonus. The private hire or taxi insurance premium may change or affect their driving record.

Based on our research and findings, those planning to start as a new PCO driver or Uber driver get the best benefits PCO insurance quote from INSHUR INSURANCE. They offer the best price for start-up drivers with good previous driving records. If you are a new PCO Driver, please feel free and get a quote from INSHUR and compare.

Best PCO Insurance Cost Introduction

When it comes to private hire taxi insurance, there are a lot of different factors to consider. This is all depend on your personal needs and driving record. Let’s discover Which policy is right for you?

What is the best PCO insurance for private hire taxi drivers?

The answer is you need to shop around or compare the best deal. That is what we put together with the best eight insurance providers, those capable of submitting Instadoc to Uber. Based on our findings, the below-listed providers are Instadoc approved insurance providers by Uber.

It’s essential to compare quotes from various providers to find the best deal. Comparing Insurance can help you find the right policy for your needs.

Disclaimer: We are not part of any below-listed companies or affiliates. We are helping drivers to get a PCO insurance quote and guide in an easy way. This post is not financial advice, and we are not acting on behalf of any below insurance providers. Please do more research on your own before committing or signup the policies.

Acorn Insurance for Uber, Private Hire and Taxi

Another best PCO insurance in the market covers you for private hire and Uber. Acorn Insurance covers Private Hire and Taxi, Uber and many more. So you can rest assured knowing that you’re protected no matter how you use your car.

Whether driving passengers around town or delivering food to hungry customers, you will have the best option with Acorn Insurance. You’ll be able to relax and focus on what you do best – providing excellent service to your customers.

So why choose Acorn Insurance? Here are just a few reasons:

- Affordable: Competitive rates that won’t break the bank.

- Reliable: with Acorn Insurance, you can be confident that you’re getting a quality product that will protect you when you need it most.

- Easy to use: Acorn Insurance’s online system makes it quick and easy to get a quote and purchase your policy. You can be covered in just a few clicks!

Acorn Insurance review on Trustpilot

Acorn Insurance had an Excellent Review on the Trustpilot website when we published this blog post with over 8,500 reviews. They have 5 out of 5 Stars averaging 4.8.

In summery of PCO Insurance with Acorn Insurance

If you are looking for comprehensive, affordable insurance for private hire and Uber, look no further than Acorn Insurance. Get a quote today and see how much you could save.

Acorn Insurance Contact Number:

Tel: 01704 33 94 00

Email: privatehire@acorninsure.com

Nelson Insurance for Uber, Private Hire and Taxi

If you’re looking for the best possible private hire insurance at the most competitive prices, look no further than Nelson PCO Insurance. Nelson Insurance is a market leader for cost-effective PCO Driver insurance.

They work with leading UK brokerages DCL Insurance and Headway Insurance to bring you an unbeatable product at an unbeatable price, with market-leading service to boot.

Instadoc approval allows Nelson brokers are digitally interconnected with Uber. They cover you whether you need one month or a year of insurance. And with their Instadoc approval, you can be sure that our policies always represent the best value in the market.

So why choose Nelson Insurance for Private Hire and Taxi? Here are just a few reasons:

- Affordable: Competitive rates that won’t break the bank.

- Reliable: With Nelson Insurance, you can be confident that you’re getting a quality product that will protect you when you need it most.

- Bespoke Quotes: Nelson Insurance offers the best and most affordable PCO Insurance with annual premiums.

💡15% EV Discount from DCL

Nelson / DCL Insurance is also helping Uber driver-partners switch to electric vehicles with an

exclusive 15% discount on their insurance. So if you’re looking for the best private hire insurance available, look no further than Nelson PCO Insurance.

DCL Insurance review on Trustpilot

DCL Insurance had an Excellent Review on the Trustpilot website when we published this blog post with around 500 reviews. They have 5 out of 5 Stars averaging 4.8.

Headway Insurance review

Headway Insurance There is no review on Trustpilot, but they have got a Google My Business review. They had an Excellent Review on Google when we published this blog post with over 730 reviews. 4.7 average rating.

Noble Claims Services review on Trustpilot

Noble Claim Services is another broker who handles Nelson Insurance Claims for PCO and taxi drivers, including DCL Insurance Accident Claims.

Noble Claim Services had a Great Reviews on the Trustpilot website when we published this blog post with over 90 reviews. They have a 4.1 average rating.

In summery of PCO Insurance with Nelson Insurance

PCO Drivers and Uber Partner Drivers have specific risks that need to be considered regarding PCO insurance cost. At Nelson, we understand those risks and can provide you with the best possible coverage at an affordable price.

Also, Nelson’s website states that they can cover Comprehensive coverage at an affordable price. “That’s why we’ve teamed up with various approved providers to offer you exclusive rates on private hire insurance.”

Best practice: Give them a call explain your goal, get a quotes and compare them.

Nelson Insurance Contact Numbers:

DCL Insurance Broker Tel: 020 8669 4466

Headway Insurance Broker Tel: 020 7408 0888

Noble Claim Service Tel: 020 8370 4994

INSHUR – PCO / Private Hire and Taxi Insurance

Whether you are an Uber driver or a private hire taxi driver, INSHUR has covered you with our specialised insurance policies. Protect yourself and your livelihood with INSHUR, the leading insurance provider for ride-sharing drivers.

With INSHUR, you can choose from various insurance coverage options to ensure you’re fully protected while on the job. Whether you need third-party liability coverage or comprehensive insurance, we have the right policy.

In addition, we understand that as a ride-sharing driver, your vehicle is your livelihood. That’s why we offer replacement cost coverage for eligible vehicles – so you can get back on the road as soon as possible if your vehicle is damaged in an accident. INSHUR offer 30 day PCO Insurance policy or Yearly private hire insurance policy with best discounted price.

Please check all the terms and conditions and cover wordings before signup.

Standard Insurance benefits:

- Receive coverage for you, your car and passengers.

- Protect yourself from liabilities.

Emotional Insurance benefits:

- Drive with peace of mind, knowing you’re fully protected.

- Feel confident picking up riders, knowing you’re insured in case of an accident.

INSHUR Insurance review on Trustpilot

INSHUR had an Excellent Review on the Trustpilot website when we published this pco insurance compare post with over 2900 reviews. They have a 4.5 average rating.

In summery of PCO Insurance with INSHUR Insurance

INSHUR is the only on-demand insurance solution designed specifically for Uber & PCO drivers in the UK.

If you are looking for an insurance solution that is both affordable and flexible, look no further than INSHUR.

With their online quoting system, you can get a quote and compare rates in minutes without providing personal information. Get your quote and compare your affordability today!

INSHUR Insurance Contact Number:

Tel: 0808 169 9165

Email: help@inshur.com

Zego Insurance

Zego Insurance is a specialised insurance provider for private hire and Uber drivers.

Zego Insurance is also Uber approved insurance provider, which means the Zego insurance system is digitally integrated with Uber.

Whether you’re a full-time Uber driver, part-time driver, full-time operator or a fleet management company, those renting PCO car rental with insurance facilities, Zego offers policies to suit your needs.

With Zego, you can choose the level of cover that’s right for you and your business, so you can feel confident when you’re on the road.

Zego Insurance has flexible payment options such as:

- PCO insurance weekly policy with auto-renewal

- PCO insurance monthly policy with auto-renewal

- PCO insurance yearly plans with great discounts based on your performance.

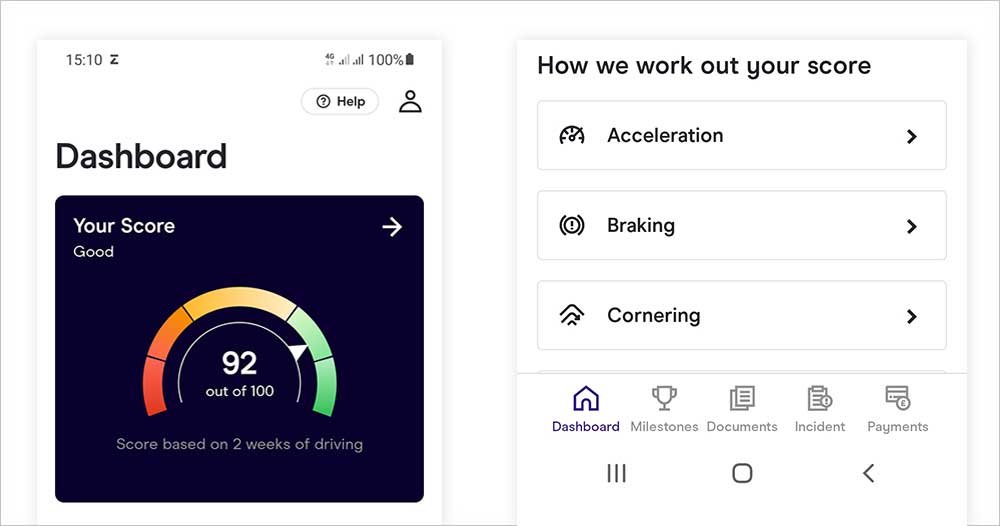

Zego Sense Mobile Application

The Zego Sense Mobile application controls Weekly, Monthly and Yearly policy cost calculations for PCO drivers. It’s a fantastic AI based app developed by Zego. The app features including:

- Monitor your driving style, such as Acceleration, Braking and Cornering.

- Scoring your daily driving based on your driving style.

- Helping PCO drivers follow best practice driving and guides to avoid accidents.

- Based on the above data points, PCO drivers can see the driving score in the app dashboard.

- The final score will determine your subsequent weekly, monthly or yearly insurance premium for PCO drivers, aka cost.

Zego review on Trustpilot

Zego had an Excellent Rating on the Trustpilot website when we published this blog post with over 6,000 reviews.

In summery of Zego PCO Insurance

If you’re a private hire or Uber driver in the UK, you’ll need to ensure that you’re legally insured to carry on private hire work.

Zego offers an excellent insurance policy covering private hire and Uber drivers. If you’re looking for affordable insurance, Zego will help you cut down your PCO insurance cost by installing the Zego Sense app.

Zego Insurance Contact Numbers and Email:

Customer Service Tel: 020 3308 9800

Sales / New Quote : 020 3053 9815

Email: support@zego.com

Freeway Insurance for PCO and Uber Derivers

Are you looking for the best insurance for your private hire, taxi or raid-hailing app driver? Look no further than Freeway Insurance! They provide comprehensive coverage at the most competitive rates in the market, so you can rest assured that your business is protected.

Here are some of the benefits of choosing Freeway Insurance:

Comprehensive coverage: They cover everything from third-party liability to damage to your vehicle. They say, “No matter what happens, we’ve got you covered!”

Affordable rates: Running a business is expensive, so They ensured their rates were as competitive as possible. You won’t find a better deal anywhere else!

Flexible payment options: They offer a range of payment options to suit your needs.

- Full payment : The best-discounted rate you can expect

- Payment Option 2: £0 Deposit with 10 Monthly Instalment payments

- Payment Option 3: Deposit with 09 Monthly Payment Option

Dedicated customer service: Freeway insurance experts are on hand to answer any questions you might have and provide support when needed.

Uber Pro Rating and PCO Insurance Cost

Finally, Freeway insurance offers the best quote for Uber drivers based on their Uber Pro rating.

This is another excellent opportunity to cut down the PCO insurance cost. See below the visual how they offer for Uber Pro Drivers. Uber pro Diamond, Platinum and Good Drivers are getting best deals based on their Uber Pro Rating cost comparison.

Freeway Insurance review on Trustpilot

Freeway Insurance had an Excellent Review on the Trustpilot website when we published this blog post with over 4,400 reviews. They have 4.5 average rating.

In summery of PCO Insurance with Freeway Insurance

PCO insurance is designed to protect professional drivers from the financial impacts of damages and injuries that may occur while working.

Based on our research Freeway Insurance, They understand PCO and Uber drivers’ unique needs and can help you find the right policy to protect you on the road. Whether you’re a full-time or part-time driver, their website offers a special discount for Uber drivers.

Get a quote and compare the cost with other quotes before you commit. This is all depending on your financial circumstance.

Freeway Insurance Contact Number:

Tel: 01928 520521

Complete Cover Group – PCO and Uber Driver Insurance | Mulsanne – Farecover

Are you looking for comprehensive and affordable insurance for your private hire, taxi or ride-hailing business? Don’t forget to get a quote from Farecover PCO Insurance.

Farecover Insurance is a part of the Complete Cover Group, an approved insurance provider for Uber Drivers. They stated in their website they offer specialised quote for Uber Drivers.

Farecover also understands the unique challenges and risks of running a transportation business. Farecover insurance has designed its insurance policies for private hire, taxi and ride-hailing companies to be much more affordable.

So why choose Farecover PCO Insurance?

Here are just a few reasons they’ve mentioned on their website.

- We understand the unique risks associated with private hire, taxi and ride-hailing businesses.

- Specialist insurance cover for PCO drivers.

- We offer comprehensive insurance cover at an affordable price.

- We have a dedicated team of experienced professionals who are always on hand to help.

Whether you’re a one-man operation or a large fleet, They have the cover you need to protect your business from the unexpected. From public liability to vehicle damage, They have you covered.

Farecover Insurance Contact Number:

Uber Partner Drivers / PCO Drivers Tel: 0344 573 1741

Walsingham Motor Insurance Limited

Walsingham Motor Insurance provides excellent taxi insurance plans at an affordable price.

They have a wide range of options to find the perfect plan for your needs. Our team is always available to help you choose the right PCO and Uber Driver insurance policy and answer any questions you may have.

Bell Insurance Brokers are Walsingham Motor Insurance direct brokers. Their website states that Uber drivers or PCO insurance can be done via Bell Insurance Brokers.

Bell Insurance Brokers review on Trustpilot

Bell Insurance Brokers had Excellent Reviews on the Trustpilot website when we published this pco insurance compare post with over 300 reviews. They have a 4.9 average rating.

Walsingham Motor Insurance is also an Instadoc approved insurance provider. You better get a quote and compare it.

Bell Insurance Brokers Contact Number:

Uber Partner Drivers / PCO Drivers Tel: 01472240208

In Summery

In order to make sure that you are getting the best price for your PCO insurance, it is essential to shop around and compare quotes from different providers. By doing this, you will be able to find the policy that fits your needs and budget.

Are you starting as a PCO Driver to conduct private hire work? The average cost of PCO insurance is around £2,800 to 4200 per year for New PCO drivers. Please check this PCO car hire and compare posts. Here you can find more information about How to start with cost-effective insurance, Rent to buy, PCO Car Hire with Insurance and other valuable guides.

This can be a significant expense for those starting their private hire work. However, there are ways to save on your premiums. Make sure you shop around and compare quotes from the listed insurance companies.

FAQ about PCO Insurance

General PCO Insurance FAQs

What is PCO insurance?

PCO (Public Carriage Office) insurance, also known as private hire insurance, is a mandatory type of insurance specifically designed for drivers who use their vehicles to carry passengers for payment via ride-hailing apps like Uber, Bolt, etc.

How is PCO insurance different from regular car insurance?

Standard car insurance typically covers personal use, commuting, and social purposes. PCO insurance is required because you are using your car commercially to transport people for a fee.

What does PCO insurance cover?

PCO insurance policies generally include:

Public liability: Protects you financially if a passenger or third-party is injured or their property is damaged in an accident you are responsible for.

Accidental damage: Covers the cost of repairs to your vehicle following an accident.

Fire and theft: Provides coverage in case your car is stolen or damaged by fire.

Legal expenses: May cover legal fees if you’re involved in a dispute.

Where can I get PCO insurance?

PCO insurance is offered by specialist insurance providers. Check our pick on PCO Insurance 2024 guide (Not a Financial Advice). This is direct feedback from Drivers. Many popular companies offer PCO policies tailored to the private hire sector. You can obtain quotes directly from providers or through comparison websites.

How much does PCO insurance cost?

PCO insurance costs vary significantly. Factors influencing premiums include:

• Your driving experience and claims history

• The type and age of your vehicle

• Your location (higher risk areas lead to higher costs)

• The coverage level you select